We offer a Purchase Accrual Ledger as an alternative to the Creditors Ledger when processing Purchases. It works in a very similar manner, but holds the “debt” to your suppliers against individual Shipments rather than against Suppliers.

People choose to use the Accruals Ledger because they don’t always have all the exact costs of a Purchase but they want to finalise the Shipment Receipt in order to update their Stock Value for the items being received. It’s important to Finalise Shipments in a timely manner because they have a direct effect on Stock Value, which in turn has a direct effect on Cost of Goods Sold (COGS) or Cost of Sale (COS). This is particularly import when using an Average Cost method. Less so when using Replacement Cost, and even less so when using Standard Cost for Inventory Valuation.

In short, using the Accruals ledger allows users to finalise the costing of a shipment based on a mix of known costs and estimated costs, depending on what is available to them. The estimated costs and any known invoices can be entered against the shipment with the Cost & Finalise Shipments function. The items on the shipment are then received into stock at the costs provided, and the Inventory Value is updated according to the Stock Costing Method in use.

When all the final costs of the Shipment are known they can be posted to the Shipment from the Accounts Payable Invoice processing function. As invoices are processed against a Shipment, the value of the invoice is removed from the Accruals Ledger and put onto the Creditors Ledger. If the estimated costs of the shipment equal the actual (invoiced) costs then the Accrual Balance on the shipment will be zero and the Shipment can be cleared from the list of outstanding Shipments.

However, if there is a variance between the two amounts then this variance will need to be taken up to a GL Account in order to clear the shipment from the Accruals Ledger.

Why does a variance need to be taken up? The reason a variance requires a GL Account posting to be made to remove it from the Accruals Ledger is because anything else would put the Balance Sheet out of balance. Since the Accrual value appears in the Balance Sheet, typically as a credit to a Liability account, and the other side of the posting has been a debit to Stock On Hand (also in the balance sheet), an entry is required to remove an Accrual Variance. This entry we call a Purchase Price Variance (PPV) in Online Advantage. A PPV occurs when a Shipment is balanced back to a zero Accrual value. In essence the GL posting made takes up the under or over statement of Stock Value based on the Landed Costs of the goods into your Inventory Value.

There are two ways to take-up a PPV.

1. Automatic Variance Take-up – where any shipment with a variance value less than the default setting in the “Auto Shipment Take-up details” function will be cleared and the difference will be posted to the GL account which is also set in that function. Note that Shipments with a “Next” month accrual will be excluded from this process and so the variance can only be cleared in the next accounting month

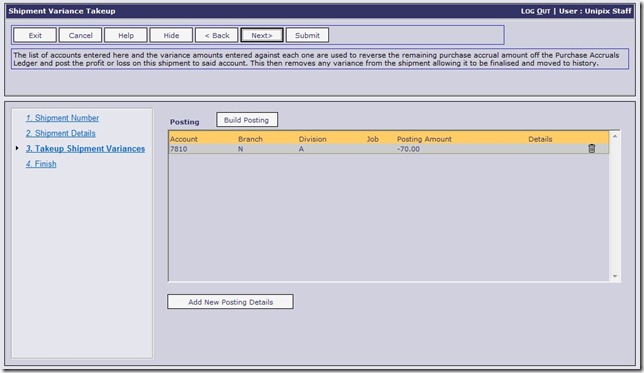

2. Manual Variance Take-up – where a shipment variance can be cleared from the Purchase Accruals ledger manually, one shipment at a time, and a GL Posting can be selected as required for each posting

Also worth noting here that there is a function to “Complete Shipments and Print Variances” as part of the “Shipment Completion” sub-system. This function will check for Shipments that have NO next month accrual value and NO variance and “archive” them. It move them from being a “current” shipments to being an “historical” shipment as part of the general system history. In essence they move off the “Purchase Accruals” ledger.