Released December 2023: Version 9.5.1462.1 Online Advantage

GL Journal reports – added new Journal Summary and Journal Details reports to General Ledger.

Customer Sales Display – a new sales display has been added that lets you view sales for a customer and a product showing sales details for all sizes and colours of the product.

Sales Orders with Work Orders – a new feature has been added so that now when you delete Sales Orders, any indent Work Orders attached to the Sales Order can also optionally be deleted. The Work Orders are not deleted if they have already moved into production.

Asset EOM – added Asset Reconciliation report to end of month Fixed Assets reports.

Asset Group report – improved the overall layout of this report.

Purchase Order – delivery instructions have been added to the purchase order docket.

Duplicate Data Reporting – a new reporting tool has been created to check for duplicate data in the database. You will find duplicate check reports in the Setup > Tools menus. New reports added include:

- Colours – where the colour name is the same

- Sizes – where the size name is the same

- Products with duplicate colours – where the product has colour codes that have the same name

- Suppliers – where the ABN is the same

- Customers – where the ABN is the same

- Employees – where the employee name is the same

Note: data comparing is treated as case-insensitive – so Yellow = YELLOW = yellow, but when comparing text, typos and different spellings won’t be picked up e.g. Sean Bean # Shaun Bean # Sean Been.

Product Brands – these have been added so that Products can be classified by “brand” e.g. “Colgate”, “Oral-B”. Set up brands under the Inventory > Setup > Product Definitions menu and add brand to a Product via Product Details maintenance. There is an upload tool available under the Inventory > Setup > Tools menu to update multiple products with a brand.

Product Brand Images – in addition to being able to categorise a product under a particular brand, you can also upload an image for the brand. The image is used in the e-Commerce portal and should be of a small size. You can upload Brands and an image name via the Inventory > Setup > Tools menu. To upload the actual images, you can use the Remote File Upload tool or contact the help desk for assistance.

Overdue Reminders – a new report to send reminder emails for Customer’s whose accounts are overdue has been added to the Accounts Receivable > Reports > Debt Collection menu.

The report sends an email to the customer with an Interim Statement attached. The wording in the email can be set up in System Manager under Standard Stationery Messages – there are 5 ‘Overdue Reminder’ email templates to choose from – when you run the report you can choose one of those 5 options. The template names are ‘Overdue Reminder 1’, ‘Overdue Reminder 2’ etc. If you would like these changed to something more meaningful like ‘Overlooked’, ‘2nd Reminder’, ‘3rd and final reminder’ or ‘Legal action’ then please email support to make that adjustment.

The reminder email with statement attached is sent to the Contact on the Customer that is marked to receive Statements via Document Delivery. If the account is overdue and there is no contact recipient available, the user who submitted the reminders to run receives a report with a list of customers who were sent a reminder and those who weren’t. Note that customers who have the ‘never print a statement’ option set are excluded from receiving reminders.

When running the report, you must enter a filter that will select overdue accounts. For example, you might want to send an email to accounts that have a balance in the ’90 days and over’ ageing period.

Take care when scheduling the report – once you enter the schedule time and click ‘Next’ – then the report is scheduled. If you also click SUBMIT then the report runs ‘now’ – so after clicking Next for scheduling, then exit the report launching window.

Note: if you want to try this out in test, it is worth emailing support first to ask if all contacts in the test database are set up with an internal email address – because you don’t want to be emailing statements to live customer addresses – it confuses people.

New E-commerce Options – we’ve added a few more configurable options for eCommerce:

- Button index style – this is an alternative UI for navigating through the product indexes on the portal. Instead of a full tile for each index that contains an image and description it shows a simplified button. You will find this under System Manager > Ecommerce Options on the Configurable Option step.

- Note label – up until now, the label next to the spot where you enter item notes in the portal has said ‘Add a comment’. You can now configure your own word so the label could say ‘Add a Note’, ‘Add a Description’, ‘Add a Message’. This setting is also under System Manager > Ecommerce Options on the Configurable Language step.

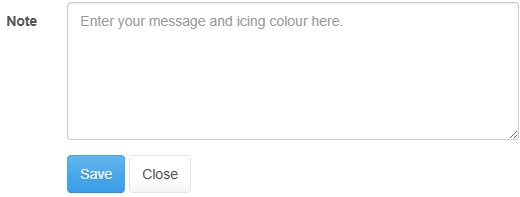

- Note hints – we’ve added a new prompt on Product Details to enter ‘hint text’ to appear when adding notes on items in e-Commerce. This is handy if you have ticked the box that says it is mandatory that some notes be entered when an item is ordered via the portal – it gives the customer a little clue as to what needs to be entered.

- Clearance items – there is a new checkbox option in Product Details (under Stock Settings) that lets you tag an item as a ‘clearance’ item. When these items are in the Ecommerce catalogue, they have a ‘badge’ overlay on the image containing the word ‘CLEARANCE’.

- Clearance Catalogue – a new dynamic ‘Clearance’ Catalogue option has been added which will dynamically create a list of items tagged as being on clearance. Set up a Catalogue Index with a suitable name and add the details to the System Settings > e-Commerce options function – the ‘Dynamic Indexes’ step.

POS Inclusive Pricing Option – enhancements to the Online Advantage application to support upcoming features of the v10 Point-Of-Sale for an inclusive pricing mode to address perceived rounding issues.

- Customer – a new setting per customer for inclusive pricing input mode on in v10 Point-Of-Sale.

- Selling prices – tax is now entered with exclusive price, so it can be adjusted to achieve a rounded inclusive price. For example, 10% of ex-price 4.55 is 0.46 (after rounding) and the inclusive price is 5.01. Adjust the 0.46 calculate tax to 0.45 and the inclusive price becomes 5.00.