Pending Release September 2024: Version 9.5.1597.1 Online Advantage

Unit tax for selling prices – there are a couple of improvements in this area as below:

- if the unit tax column is left blank on the ‘Product/Price/Inventory’ upload function, the system will automatically calculate the unit tax using the product’s tax rate

- when copying prices in the Cost and Prices function, the unit tax will also be copied now

- the ‘Product/Price/Inventory’ download now includes the unit tax fields to match the upload function

Selling whole units’ conversion – a new flag has been added to Product Details that will cause the stock units for a product to round to a whole number when there is a selling conversion. For example, if a customer wants to order paint to cover 10 square metres and that converts to 6.55 tins, then with the rounding flag set for the product, the number of tins to order is round up to 7.

The same sort of rounding could apply to many other types of products like tiles, wire, lengths of wood, carpet and fabric. The use of this is optional and should only be required for products that require a rounding of the Stock Unit to whole numbers.

Daily Sales Report – a new report has been added to the Order Management ‘Statistics and Analysis’ report menu that shows the sales orders entered for a given date.

Sales Charges by Colour – you can now apply ‘other charges’ to a particular product and specific colours.

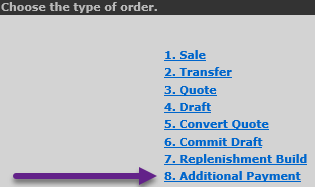

Sales Order Additional Payments – there is new option in Sales Order Entry lets you enter and allocate a payment receipt against a sales order – even if it has gone through to the picking stage of the ordering process. This can be useful in situations where the customer has paid a deposit when the order is entered, and then pays the remainder when the order is collected. Note that this feature is only available when the payments in sales order entry feature is activated.