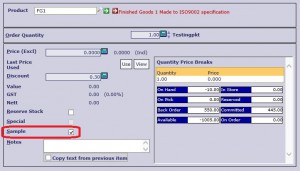

‘Sample’ sales are a particular category of sales that can occur in the system when a sales line item is entered/sold through the Order Processing system at no charge i.e. zero unit price. It is a great way for an organisation to track the cost of providing sample stock to customers.

‘Sample’ sales are a particular category of sales that can occur in the system when a sales line item is entered/sold through the Order Processing system at no charge i.e. zero unit price. It is a great way for an organisation to track the cost of providing sample stock to customers.

The system will use this option to denote that a different cost of sales posting should occur – different to what a normal invoice/credit note transaction would create. Sample sales are assumed to be at a zero price and in fact the routine will not allow an item to be marked as a ‘sample’ unless the unit price is set to zero. It should also be noted that when the unit price is set to zero by the operator, the system automatically assumes that the transaction is a ‘sample’ sale.

The main difference between sample sales and special sales is that samples are NOT recorded on the Sales Analysis system and the cost of sales does not go to the normal cost of sales account posting. This is so that these transactions do not distort the sales figures, in particular margin/markup percentages, since they are effectively all cost and no sales value.

Sample sales transactions are posted via their own account code on the Product Groups details. This allows users to post the code of ‘sample’ sales to an ‘expense’ account or to a separate ‘cost of samples’ account in the General Ledger. Note that samples are also highlighted on the invoice and credit note registers separately to allow for reconciliation of the posting.